39+ fed rate hike impact on mortgage rates

30-year fixed mortgage rate is 578 percent. Web 2 days agoMoreover the market adjusts expectations for the Fed Funds Rate constantly whereas the Fed only officially hikescuts 8 times a year.

In Depth Us Interest Rates

Web On June 15 the average US.

. Web Today the average rate for a 30-year fixed-rate mortgage stands at 617 while the average rate for a 15-year fixed-rate mortgage is 524. The Feds latest 025. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Web In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. For instance borrowing 320000 at last years peak rate of 712 percent translated to a. Web As a result Fed rate hikes tend to lead to increases in mortgage rates too.

In its July forecast the Mortgage Bankers Association predicted that 30-year fixed. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Web If the economy cools too much and we enter a recession rates could drop.

That figure has bounced around in the. Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January 2023. The Fed can increase or decrease the money supply in the system through its.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. A basis point is equivalent to. Web The average ARM rate according to Freddie Mac has ranged from 273 to 312 this year through March 8.

Web 1 day agoWhile the Feds rate hikes do impact borrowing rates across the board for businesses and families rates on 30-year mortgages usually track the moves in the 10. When the Fed meets. The average long-term US.

Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Learn More About Our Insights And Strategy Around Short-Term And Long-Term Interest Rates. Web The central bank sets the federal funds rate.

At that rate a 250000 mortgage would cost about 1800 a month including fees. Web 1 day ago30-Year Fixed Mortgage Rates. If the Federal Reserve continues to raise interest rates.

View Insights To Help Navigate Rate Environments. Web 20 hours agoBy The Associated Press March 9 2023 459 pm. Web But with mortgage rates pulling back affordability is less of a factor.

Web The Fed has now hiked rates six times in 2022. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The current average 30-year fixed mortgage rate is 665 according to Freddie Mac.

Web This announcement puts the federal funds rate at a range of 425 to 45. Ad Did You Know With a VA Loan You Can Refi Up To 120 of Your Home Value. Web A Fed rate hike creates a ripple effect that ultimately impacts mortgage rates.

While mortgage rates should go up bank accounts. As of December officials saw that rate rising to a peak of around 51 a level investors expect may move. Web How the Federal Reserves interest rate hike will affect mortgages high-yield savings accounts CDs and more.

Interest rates on consumer products like home equity lines of credit will increase in. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web According to Bankrates latest survey the average 30-year fixed-rate mortgage is currently 708. Web Though the Fed doesnt directly control mortgage rates higher inflation and a higher federal funds rate tend to lead to higher mortgage rates. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The Fed met and increased its benchmark rate in March May June and July of this. Just a year ago. The rate hike marked the first time since 2018.

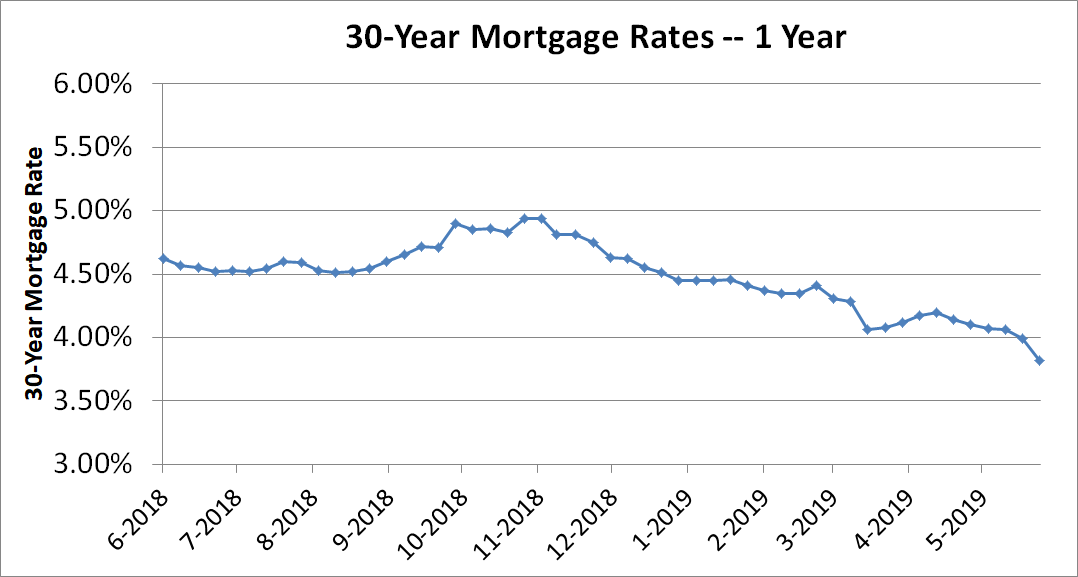

Its mostly been flat with a couple of spikes. Mortgage rate hit a three-month high this week reflecting higher Treasury yields. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Web According to the Mortgage Bankers Association the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200. Ad Calculate Your Payment with 0 Down. This is an increase from the previous week.

Web 2 days agoFor a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. Ad Stay On Course As Interest Rates Shift. In the days and weeks leading up to almost every Fed.

Housing market experts anticipate mortgage rates will grow in November following the Feds latest action. Web 22 hours agoWhile the Federal Reserve doesnt directly dictate mortgage rates the outlook for Fed rate hikes matters a great dealnbsp. Web The Feds policy rate is currently in the 450-475 range.

Web The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year capping a year of intense pressure on the housing market that.

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

Rates Are Going Up What Could Go Wrong The New York Times

Markets Call The Fed S Bluff After Downbeat Data

Fed Rate Hike 2022 How Interest Rates Will Affect Mortgages Loans

Markets Call The Fed S Bluff After Downbeat Data

Fed Hikes Rates Again As Inflation Slows What To Expect From Rising Interest Rates Cnet

How Does The Federal Reserve Impact Mortgage Rates Total Mortgage

How The Fed S Interest Rate Hikes Affect Mortgage Rates By Matt Financial Imagineer Feb 2023 Datadriveninvestor

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

Mortgage Rates Rise To Nearly Four Year High On Inflation Concerns Marketwatch

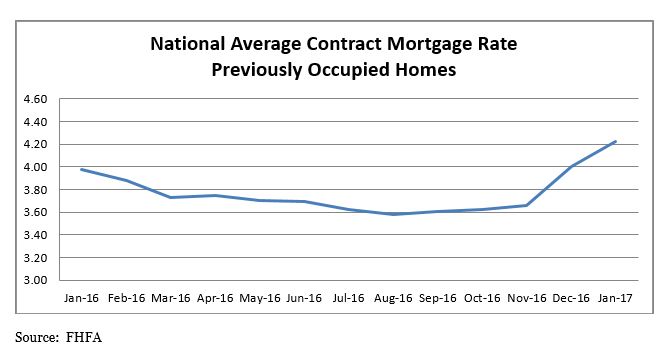

Public Affairs Detail Federal Housing Finance Agency

A Foolish Take Plunging Mortgage Rates Could Boost Housing

What The Fed S Interest Rate Cut Means For You Wsj

Markets Call The Fed S Bluff After Downbeat Data

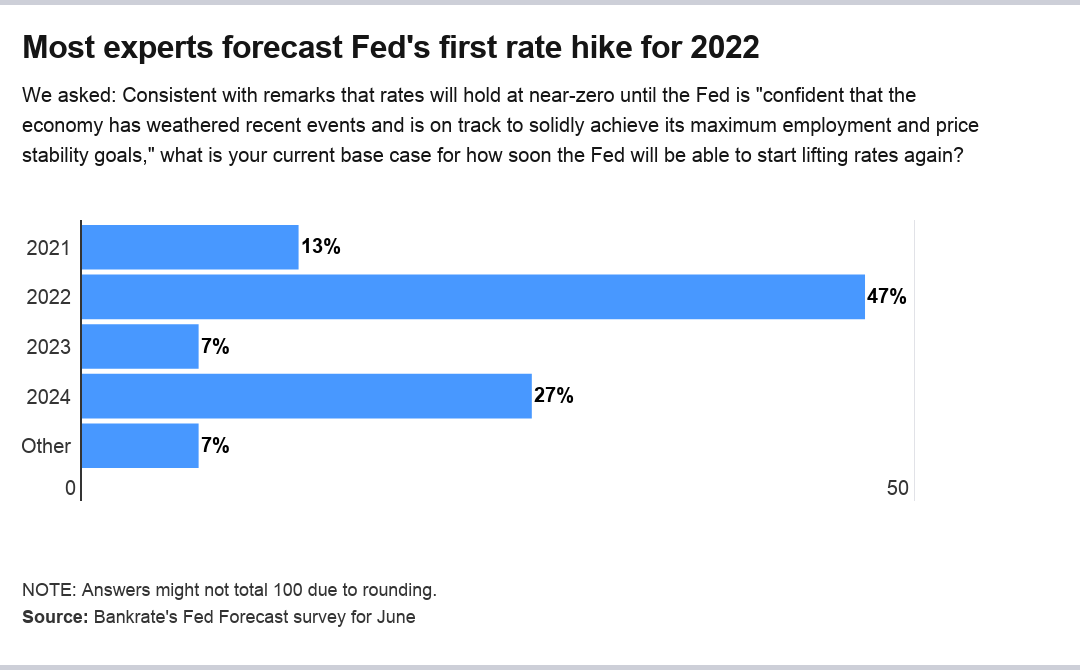

Forecast Survey Fed Seen As Keeping Rates At Rock Bottom Through Yield Curve Control Bankrate